During last month’s ANA sales, Heritage and Stack’s Bowers auctioned about $100 million worth of numismatic material. Several NGC-graded coins sold for over a million each, including the 1921 Double Eagle graded NGC PF 64+, which realized a little over $2 million USD. The staggering total included several world-class collections that have been carefully assembled over many years.

Selling your rare coins at auction is an easy decision if you have a collection that has been formed over decades. The market will almost always handsomely reward anyone who consigns such material.

Unfortunately, not many collectors are in this position.

Most people have collections that have been assembled in the last five to 10 years, and sometimes they need to sell their coins for one reason or another. Consigning coins to auction is not always a simple matter and there are many factors to consider. The following advice can apply to collectors and dealers consigning material for sale.

Coin Consigning Rule #1

Not everything does well at auction. The biggest mistake many collectors and dealers make is to consign material to auction that they have been unable to sell through other channels. I have seen lots of fellow coin dealers purchase nice collections and then start selling the best coins at the first opportunity. They are quickly left with the off-quality or unpopular material.

These coins will sit around for months, and the frustrated dealer will consign them to auction, hoping for the best. They are usually disappointed. If the coins are sold without reserve, they might face steep losses. If the coins do not meet reserves, then they will still have the coins and must pay buyback charges. Neither result is pleasant.

To avoid the above scenario, you should save the best coins for auction and sell the off-quality coins at a discount as soon as possible.

This advice might sound simple, but it is vital to have the greatest success when consigning coins. To achieve the best results, you should only consider selling coins at auction that a collector would be eager to purchase. You want collectors to be bidding competitively for your coins and not dealers who are buying coins, especially since they have factored out the commissions.

For instance, there is no need to sell generic gold coins in an auction setting. The auction commissions would be higher than selling directly to dealers who specialize in this field. On the other hand, if you owned a 1932 Double Eagle, collectors would be happy to battle each other in an auction format to purchase the coin.

For instance, there is no need to sell generic gold coins in an auction setting. The auction commissions would be higher than selling directly to dealers who specialize in this field. On the other hand, if you owned a 1932 Double Eagle, collectors would be happy to battle each other in an auction format to purchase the coin.

I am often asked if a collection of coins should be broken up or sold as one unit. In most cases, it is best to sell coins individually.

The explanation for this is rather simple: Most people cannot afford to purchase a complete set of anything. The price point would be too high and many already have some of the same coins if they are interested in the series. There are exceptions, such as early Proof sets from 1858 to 1915. Many collectors or dealers will pay a premium to acquire a matched, original set.

Additionally, you should not always consign your entire collection for auction. Auctions are best suited for high-quality, certified material. If your collection has a variety of material, then you might want to have the auction company cherry-pick your material best suited for auction. The remainders can be sold to a local coin shop or through another venue.

With or Without Reserves

One of the biggest questions facing consignors these days is whether to place reserves. The auction houses make more money if all your coins sell, so their advice on this issue can sometimes be self-serving. Consigning a valuable collection to auction without reserves can be a scary proposition; however, there are several reasons to consider this option.

The best overall commission rates are usually given for coins consigned without reserve. More importantly, bidders are more excited when coins are offered without reserve because they love the security of an underbidder and will sometimes end up stretching if they feel a coin is fresh and being sold unreserved.

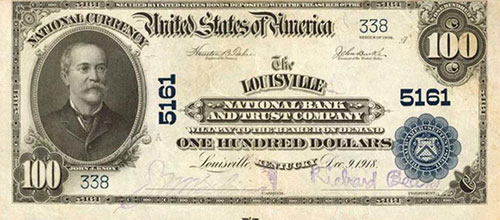

However, there are certain cases where setting a reserve can be very important. This usually applies to thinly traded markets or a specialty field. There may be very few buyers for a coin or piece of currency. A prime example of this would be Kentucky National banknotes, which I collect. If someone consigns a note that is needed for my collection, I will bid aggressively (maybe irrationally) to purchase the lot.

The problem is that I might be the only bidder interested. In this case, if the lot were sold unreserved, I might buy the note for much less than I was willing to pay. It would be wise to set a reasonable reserve. Setting reserves can be a very tricky business and seeking advice from an expert is highly recommended.

Types of Numismatic Sales

Another decision to consider is which type of sale to which to consign your coins.

These days, major convention auctions will have total sales in the tens of millions of dollars. For smaller consignors, your collection could easily lose the crowd or be overshadowed by higher-quality coins. The commission rates can also be higher for major sales (where fees are due to a convention host) and should be taken into consideration.

The 2021 ANA sales were conducted solely online with great success. No one feels the prices were diminished because of the lack of floor bidding. Heritage and Stack’s Bowers probably made the decision to conduct the sales online because of COVID-19 concerns and the cost savings involved. Many dealers and collectors worry about the future of in-person auctions and the impact these changes will have on conventions.

Convention sales are about gathering consignments, and my guess is that in the competitive world of rare coin auctions, this will not substantially change in the foreseeable future.

There are several online-only auction companies as well. These companies have been making great strides in the last few years, riding the new wave of interest in numismatics.

Bottom line, look for a sale that fits your collection. Also, do not be afraid to negotiate for the best possible commission rate (see above note about the competitive auction market).

Nearly all the large auction houses maintain a database of past sales results. Compare these results for more information about who could produce the best bottom line when consigning. Be sure to take into consideration whether the coins were obvious upgrades, as this can skew the comparisons with your material.

The recent sale of the 1933 Double Eagle for over $18 million revealed an interesting strategy that is usually reserved for the supercharged art world. Sotheby’s arranged for a third party to guarantee the minimum auction price for the coin. The final sale price was adjusted for the third-party fee, which may have been for the successful bidder. These arrangements are not unheard of in the numismatic world but are quite rare. For a giant collection, especially with speculative material, collectors could explore this option with auction companies.

Other Tips to Consider

Many of you have invested years and large sums of money into your collection. When it comes time to sell, some careful planning will pay huge dividends. As always, it is highly recommended to seek advice from an expert when making big decisions about your collection. This may be the dealer who helped assemble your collection or someone who is an expert in the specialty you have chosen to collect. The consulting fee for these services can be well worth the money.

Recently, a client told me that he had designated a certain auction company to sell his coins after his passing. I asked if a commission rate had been discussed and was told no. This would put the executor of the estate in a difficult position, as they could not negotiate commission rates. You should consider this if you have made these arrangements in your will or estate plans.

Finally, remember that the auction business is very competitive, and you should shop around and for the best overall consignment strategy that meets your needs.