Markets are being tested by the COVID-19 crisis; so far, the rare coin market is passing

The internet has been one of the most significant driving forces for numismatics since the late 1990s. Indeed, the hobby has been forever changed by this amazing tool of the modern age. Collectors now have more information available at their fingertips than advanced hobbyists from decades ago ever could have dreamed. Doing numismatic research when making a purchase decision is now ridiculously easy.

Collectors also have access to rare coin dealer inventories around the globe. There are important rare coin auctions on a weekly basis. This is so different from years ago when coin shows, trade journals, and coin shops ruled the market for rare coins. If you lived in a remote location and disliked travel, your access to rare coins was very limited. To say the least, a lot has changed in 20 years.

The COVID-19 pandemic has further driven the rare coin market to the internet in a major way.

For the last 40 years or so, my monthly routine included attending at least two coin shows somewhere around the country. Sadly, I have not left Lexington in over three months. Nearly all of the business I have been conducting has been on the internet — either direct sales or wholesale to others who sell on the web. Nevertheless, business has been amazingly brisk!

Because of quarantines, stay-at-home orders, and lost jobs, Americans have been home surfing the internet in record numbers. Many of them have either discovered or rediscovered the hobby of numismatics. A few months ago, the American Numismatic Association (ANA) conducted a membership promotion during National Coin Week. Over 3,500 new collectors signed up as members of the ANA. That is a staggering number of new members in such a short time. ANA membership now stands at over 28,000 members.

Winners and Losers in the Rare Coin Market

As with every crisis or seismic event, there will be winners and losers. Nearly every coin dealer I have spoken to in recent weeks who has a significant web business is doing very well. Some have even related to me that they are experiencing records sales. The extremely large firms with rare coins and bullion operations are seeing sales explode. Their biggest issues in recent weeks have been finding material to sell.

Losers in the COVID-19 crisis include the large number of dealers who count on coin shows for the majority of their business.

Coin shows everywhere have been canceled since mid-March. The ANA World’s Fair of Money scheduled for Pittsburgh in August has been suspended until a later date (if it can happen at all). I and many others were hopeful a few weeks ago that we might be able to start attending shows soon. The recent rise in coronavirus cases around the country now puts that in doubt.

Many major players in the hobby have discovered how important coins shows are to the supply chain. The flow of new material that normally traded during a major coin show has now been eliminated. A lot of smaller dealers would buy coins across the counter in shops and sell them at shows. The supply of new material in shops has slowed to a trickle, and there are no shows to attend. Even the dealers who produced new coins by having them graded at shows are being seriously impacted.

The good news of all of this is that coins are selling well on the internet, and the supply of new coins has been drastically reduced. For several years now, the rare coin market has been negatively impacted by an oversupply of coins. More coins were coming onto the market than new collectors were willing to buy. There has been sustained price erosion of rare coins for several years. If current market conditions continue, there is little doubt that prices for rare coins may finally move in a positive direction.

Getting to the Art of the Matter

Late in June, the art market experienced a major test when Sotheby’s conducted a marquee evening auction online and by phone. The Monday night sale fetched over $360 million, with the highlight of the sale being a Francis Bacon triptych that sold for nearly $85 million. Bidders around the world participated in the live-streamed event.

According to The Wall Street Journal, the auction house had to convince consignors to continue with the sale despite the current COVID-19 crisis. Reportedly, Sotheby’s had to give price guarantees to secure several of the major pieces that were sold Monday night. I’m sure executives at the firm are breathing much easier now based on the results.

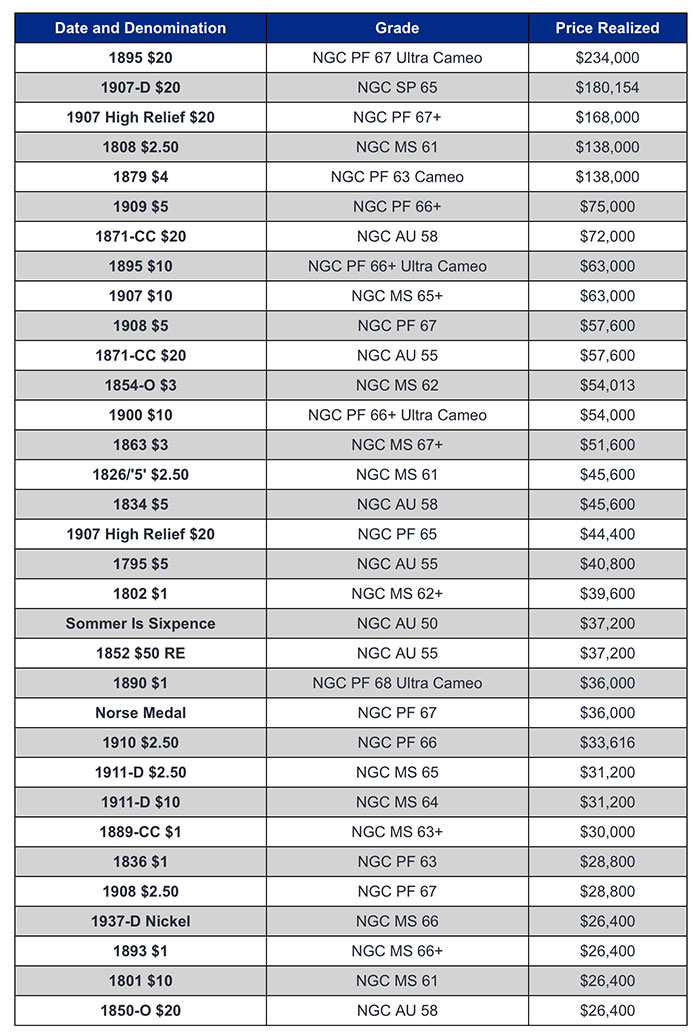

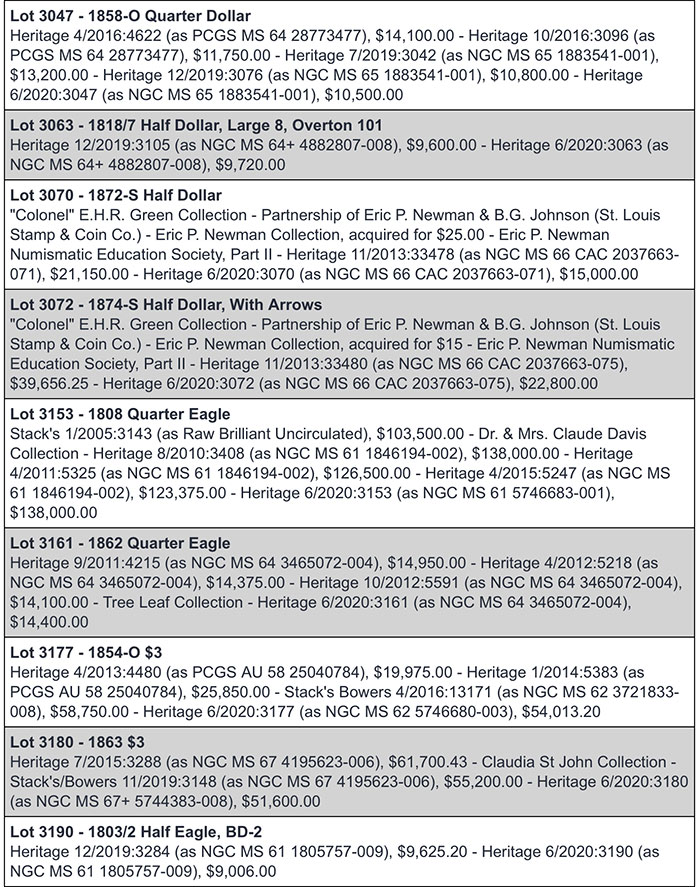

The next benchmarks for the rare coin market will be the Heritage and Stack’s Bowers 2020 ANA sales, which have now been moved online due to the suspended convention in Pittsburgh. There are several major collections being offered for sale, and I’m sure both auction houses are hoping for the same success that Sotheby’s experienced. It is obvious that rare coin buyers are becoming more comfortable spending large sums through online bidding.

It would be interesting to ask if returns have increased given that buyers have not personally examined the coins. Digital photography has become so advanced that it may no longer be much of an issue. Some buyers still have representatives to examine coins, but given travel restrictions, that may not be possible for the time being.

There have been a few major tests of the rare coin market at auction in the last couple of months as well. Heritage conducted the June Long Beach Sale in Dallas with nearly all of the buyers participating online. The sale was successful, from what consignors have related to me. There were very few unsold lots.

As more and more collectors turn to online purchasing, the hobby finally has a chance to grow. There has been a huge increase in Google searches for rare coins, bullion and collectibles. Many businesses in America and around the world are going through difficult times. The business of numismatics is very fortunate that so many individuals are turning to their hobbies for entertainment and comfort.

I personally miss coins shows the most and truly hope to see some of you again in the near future.