For several years now, I have joked that people know so little about Bitcoin that they ask my thoughts on it because I’m a coin dealer. In general, most individuals that I speak with consider Bitcoin to be a speculative bubble waiting to pop. The recent rise of Non-Fungible Tokens (NFT) is making peoples’ heads spin, but the future of NFTs is up in the air until the tokens become more widely accepted and understood as an asset class.

Riding the Crypto-Current

A digital-only artwork recently sold for more than $69 million USD and was paid for with cryptocurrency. The sale is not only turning heads but also creating a stampede for those seeking the next digital gold rush. Famous living artists are exploring the medium, and established auction houses are devoting considerable resources to finding ways to monetize the new craze. Sotheby’s and Christie’s summer cornerstone sales are sure to include such offerings as well.

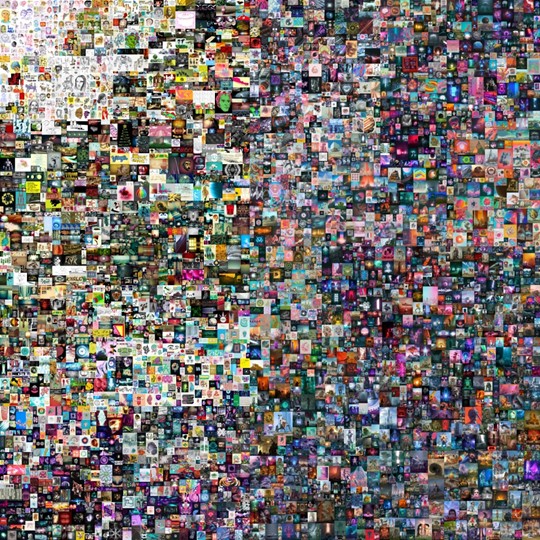

Everydays: The First 5000 Days, by Beeple. Source: Christie’s

The highly touted auction records and private sales of NFTs are likely being fueled by cryptocurrency wealth. The aforementioned sale of Everydays: The First 5000 Days by the artist known as Beeple, certainly was. It was purchased by two cryptocurrency billionaires from India who wanted to demonstrate the power of digital currency. It is also possible that some of the recent trophy coin multi-million-dollar sales have been paid for with cryptocurrency wealth.

Additionally, NFT assets are being purchased by those in the gaming community who, for many, predominately live in a digital world. Gamers have recently started buying “digital real estate” in the games they spend so much time playing. This is an interesting extension of selling online tools that give gamers an edge, which has already been a multi-million- and possibly billion-dollar business for years.

What About the Rare Coin Market?

Many of you are probably wondering what any of this has to do with the rare coin market. My guess is, probably more than most of us realize. The COVID-19 pandemic has pushed governments around the world to spend trillions of dollars to prop up economies decimated by shutdowns. The United States alone has spent $5 to $6 trillion (and counting) in relief funds.

Prior to the pandemic, there were great concerns about federal deficits. Those concerns have taken a back seat to economic recovery and politics. For some reason, lawmakers now seem to think the long-term damage of massive deficits is less important than keeping the economy going. Regardless, trillions of dollars of newly printed money should be making gold skyrocket!

Sadly for the hard-money crowd, the opposite has occurred. Gold has recently slipped from about $1,950 to $1,750 per ounce. During the same time period, Bitcoin has risen from $11,000 to over $50,000 per unit. It is undeniable that Bitcoin has been stealing the spotlight from gold as a hedge against inflation and a drop in the US dollar’s value.

Most large Wall Street firms have created departments for cryptocurrency investments, and many large corporations now park excess funds in Bitcoin instead of in gold or foreign exchange. Elon Musk recently invested more than $1 trillion in Bitcoin for Tesla. Bitcoin is outshining gold, and the flow of capital proves this: follow the money.

Even though gold and silver prices are depressed on the commodities exchanges, there is incredible demand for physical product. Premiums to purchase gold and silver bullion are near record levels — that is, if you can find it. Our Sarasota Rare Coin Gallery store limits purchases of silver to 40 ounces per day per customer. Gold and Silver American Eagles are nearly impossible to find. A lot of individuals are concerned about runaway government spending, so they’re looking to buy gold and silver for financial security.

The NFT phenomenon is another matter. Many people in the rare coin industry are trying to figure out if there could be a play in this space. My expertise and understanding of the NFT markets are limited, but I do know the technology is based on blockchain and the security it currently provides. Artists and players in the art market are extremely excited by the possibilities NFTs might offer those who seek to retain some rights in future sales of their works.

Investing in the Future

Perhaps this could be applied to rare coins in some way. The fractional sale of mega-coins or collections could be another possibility. Who wouldn’t want part ownership of the 1787 Brasher Doubloon graded NGC MS 65 that recently sold for $9.36 million? This new way of looking at rare coin investing could bring in giant sums and attract a much younger demographic.

Gold and silver bullion, rare coins, and most collectibles have long been the investment of choice for those who prefer tangible property. Cryptocurrency and NFTs are the opposite of a tangible asset but are still a viable investment option.

Let’s dismiss the idea of digital assets as fantasy. The reality is that digital assets are probably here to stay, and they could have a big impact on the hobby going forward. It will be interesting to see who comes up with ideas to monetize digital assets for the rare coin market. I’m highly optimistic about the hobby, and digital assets could add more fuel to the fire. I just may need to hire some bright young minds to help me navigate this brave new world.