One of the oldest pieces of advice given to anyone new to the hobby is “buy the best that you can afford.” This old adage is often shared along with “buy the book before the coin.” These days, buying a numismatic book is still great advice, but there is also an avalanche of data online. Collectors and dealers now have information that previously took years to learn at their fingertips. Understanding that information can be tricky, and I plan to address that in a future article.

Is buying the best coins you can afford really the best strategy for collectors? Over the course of my career, I have handled thousands of coin collections. I have seen firsthand the results of different styles of collecting. Without a doubt, the most successful collectors have been the ones that cared about quality and were willing to pay for it.

Whenever someone offers me a collection, it does not take long to figure out the collecting philosophy the person utilized. We have seen everything across the spectrum, from the cheapest example they could find to only the finest known. The tangible results of the different strategies are revealed when it’s time to sell.

Recently I was interviewed and asked for advice to share with new collectors. Of course, “buy the best that you can afford” was one of the first things mentioned. When it is time to sell, you want the buyers to think “wow,” not “ugh.” In the past, the rare coin market was dominated by investors and dealers who sold coins to investors. Today, the market is very collector-based and eye appeal has never been more important.

The most disappointing results are when collectors buy coins with damage or problems. What seems like a bargain in comparison to a problem-free coin seldom translates into a good investment. When NGC first started grading coins 40-plus years ago, damaged and problem coins were sent back in “body bags.” This means they were not holdered and, therefore, still considered a raw coin. NGC now utilizes Details grading, with the offending problem identified.

As mentioned, there is a market for Details-graded coins from collectors who want a coin certified but are willing to compromise on condition. The coin may be one of the “key dates” they need but would be unaffordable otherwise. The strategy fills the need for collectors trying to complete a set, but it is seldom the best investment when it is time to sell. A better idea would be to buy a lower-grade coin without problems.

Buying the best you can afford really fits the current market demand for coins with great eye appeal. Collectors are very concerned about what a coin looks like and are willing to pay for superior coins. That is why you can review auction records and see several coins in the exact same grade sell for very different prices.

The use of auction records can be confusing for collectors who do not understand the range that eye appeal can have on coin values. Another bit of advice I give collectors is to attend lot viewings at major sales and study this in person. You will soon see for yourself how different coins in the same grade can be.

Historically, you can see that buying the best coin possible for your collection usually yields the best results. If you had purchased a damaged Extremely Fine 1853-D Half Eagle in 1994, the coin would have cost about $500. The same coin certified as XF 45 would have cost about $800. Today, the damaged coin might sell for $900 and the problem-free coin would easily fetch about $3,000.

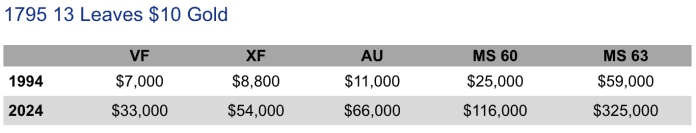

This sort of math plays out in nearly every series you examine. For a more advanced examination, you could look at 1795 13 Leaves $10 Gold pieces. The following table compares Greysheet bids from 1994 and 2024:

Using the above study, buying the best possible coin clearly yielded the most successful result. If you had purchased a damaged or cleaned coin in 1994, you would be severely disappointed, in comparison to what a problem-free coin would now command.

Buying the “best coins that you can afford” does not mean you have to only buy Gem coins. If you collect Morgan Dollars, the best coins that would fit your budget might be MS63. That is the grade before many of the dates really skyrocket in price. For collectors of Morgan Dollars and of about any other series, I would recommend not sticking to any one grade.

For common dates of the series, you should purchase MS65 or 66 coins with great eye appeal. When trying to buy the rare dates, buying an attractive AU or MS60 coin would be the best option.

Many collectors have the mistaken belief that assembling a “matched grade” set is the best option and that the coins will sell for more as a set. The reality is that almost all sets are broken up when they re-enter the market and the focus will be on the quality of every coin and not that it is a “matched set.” Even the best collection ever assembled is broken up and sold individually.

Regardless of what you collect and what grade you collect, focusing on quality is absolutely the best option. That is why having an understanding of coin grading is essential for any collector, even though coins have been certified by a third party.

Each year, we have several collectors who take my Advanced Coin Grading class that is presented at the ANA Summer Seminar. These collectors are looking for tips on how to buy the best coins possible for the grade.

The “buy the best coins that you can afford” advice has been around for decades, but it still holds true and will give you the best chance to get the “wow” and not the “ugh” when it comes time to sell.